Loreen & Lane’s Independent Brokers have over 100 hours of training in both Health and Life products and are able to offer an assortment of products to fulfill your needs.

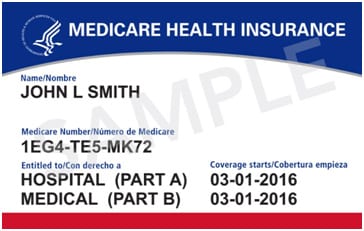

All U.S. citizens are eligible to receive Original Medicare at the age of 65. However, if you are under the age of 65, you may qualify for Medicare if you have: ALS, ESRD (End Stage Renal Disease) or have received disability income from Social Security for 24 months. Original Medicare consists of Part A (inpatient hospital services) and Part B (outpatient medical services). Prescription drug coverage is available separately under Medicare’s part D (Prescription Drug Plans) or through part C (Medicare Advantage Plans).

Only being enrolled in Medicare Parts A and B leaves you at risk of paying more out of pocket for many common medical bills, such as prescription drugs, specialists, dental care, and hearing aids, just to name a few.

Part A: Been a US citizen or legal resident for at least 5 years and have worked for at least 10 years. You are automatically enrolled at the age of 65.

Part B: Can be purchased at age 65 for a monthly premium.

New to Medicare: Let us help guide you through the complexities of Medicare. We are there for You!

Enrolled in Medicare Parts A and B.

Enrollment Period: You can only enroll during certain times during the year.

We would be happy to help identify if you are eligible for an enrollment period.

If you’re enrolled in Medicare Part A and/or enrolled in Part B.

Enrollment Period: You can only enroll in Prescription drug plan at certain times during the year similar to Medicare Advantage Plans.

We would be happy to help identify an election period for you.

Medicare Supplement insurance plans, “Medigap policies”, are used in conjunction with Original Medicare (Part A and Part B) to fill in coverage gaps, including copayments, coinsurance and deductibles, as well as emergency overseas healthcare. These plans are sold by private companies.

Medicare Supplement plans pay for costs you’d normally be responsible for paying under Original Medicare as long as you pay your monthly premium. The best is that you’re not required to use a network of providers—choose any doctor or specialist that accepts Medicare, and never worry about losing your preferred physician.

Medicare Supplement insurance plans do no not cover long-term care, hearing, vision, dental or prescription drug coverage. For Medicare plans offering coverage beyond hospital and medical insurance, see our Medicare Advantage plans.

Enrolled in Medicare Parts A and B.

Plans: All policies offer the same basic benefits, but some offer additional benefits, so you can choose which one meets your needs.

YOUR MEDIGAP OPTIONS

The chart below shows basic information about the different benefits Medigap policies cover.

Yes = The plan covers 100% of this benefit

% = The plan covers that percentage of this benefit

No = The policy does not cover that benefit

N/A = Not Applicable

| Medigap Plans | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Benefits | A | B | C | D | F | G | K | L | M | N |

| Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Part B coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes*** |

| Blood (first 3 pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled nursing facility care coinsurance | No | No | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A deductible | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

| Part B deductible | No | No | Yes | No | Yes | No | No | No | No | No |

| Part B | No | No | No | No | Yes | Yes | No | No | No | No |

| Foreign travel exchange (up to plan limits) | No | No | 80% | 80% | 80% | 80% | No | No | 80% | 80% |

| Out-of-pocket limit** | N/A | N/A | N/A | N/A | N/A | N/A | $5,240 | $2,620 | N/A | N/A |

Footnotes:

* Plan F also offers a high-deductible plan. If you choose this option, this means you must pay for Medicare-covered costs up to the deductible amount of $2,240 in 2018 before your Medigap plan pays anything.

** After you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in inpatient admission.

** Please note: Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

If you are looking to cover specific financial responsibilities in the possibility of your unexpected absence, like a mortgage or college expenses, for a specific time period at a reasonable price, consider term life insurance.

Whole Life Insurance is designed to protect you your entire lifetime and offers level premiums. It differs from term insurance in that a portion of the premium goes into a guaranteed cash value account that is accessible.

An affordable way to provide the financial resources necessary to cover your funeral costs and other final expenses or outstanding debts.

A permanent insurance that can last a lifetime with the monthly premium building cash value within the policy.

An insurance product that helps pay the cost of long term care; which is a variety of medical and non-medical services for individuals that are generally not sick in the traditional sense, but instead, are unable to perform the basic activities of daily living such as dressing, bathing, eating, toileting, and walking. Long term care insurance covers care services that generally are not covered by health insurance, Medicare, or Medicaid.

We Know Medicare and Life Insurance | Loreen & Lane, All Rights Reserved © 2023

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1800MEDICARE to get information on all of your options.

We Know Medicare and Life Insurance | Loreen & Lane, All Rights Reserved © 2022

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.